Appendix 1 – Organisations and the Concrete Industry

GOVERNMENT

In February 2008 the Danish government took initiative to form a Climate Consortium that:

Short term is to secure climate focus up to the 2009 United Nation’s Climate conference in Copenhagen and

Long term is to improve Danish corporation’s global competitiveness and attractiveness towards investments and future workforce.

INDUSTRY

The Danish concrete industry participates in the Climate Consortium, and faces the fact that half of the energy consumption in Denmark comes from the use and construction of buildings and infrastructure.

Source: Author’s own creation

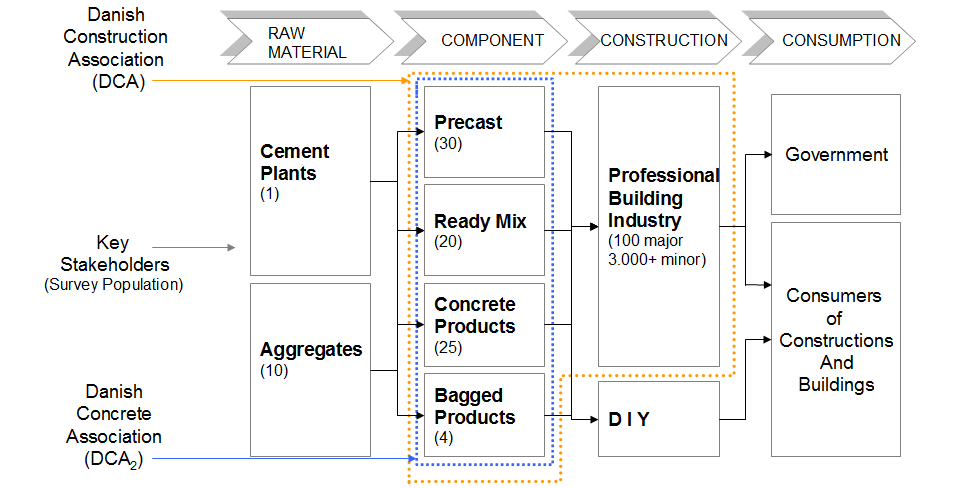

The shared industry responsibility is organised in two organisational bodies.

- Danish Construction Association (DCA) constituted by among others

- Sub-organisations of craftsmen/contractors and

- the Danish Concrete Association (DCA2), constituted by concrete component producers

Both DCA and DCA2 are active with initiatives fronting the external governmental and social challenges.

Shared objective within the industry is to “Secure sustainability of concrete by doing the best possible for people and the environment, without harming future generations”.

Three strategic focus areas are environmental, aesthetic and social responsibility. Based on this the industry has analysed, studied and marketed the sustainable impact of concrete (cement + aggregates = concrete) in buildings from a “cradle-to-grave” perspective.

As active partners in the industry AP and other raw material suppliers will have same benefits as other stakeholders.

CONSUMERS:

Increasing awareness of businesses’ environmental and social responsibility seems to be enhanced by younger generations and excessive and fast information via the internet.

The global increase in environmental focus and communication is influencing customer demand as well.

Market analysis states that wooden homes have increased market share from 4.5% in 1998 to 25% in 2003 and is estimated to 35% in 2006 according to the Wood Branch Association (TOP www.top.dk). Improved “green” reputation is seen as the main driver of the growth.

The consumer confidence indexes provided yearly by the Danish Consumer Agency indicate that consumers hold average confidence to building material suppliers.

Government agency analysis and press releases in resent years stating that Danish building materials were 20% more expensive than in neighbouring countries is seen as main influencer.

Consumer confidence indexes measure bricklaying craftsmen/contractors among the lowest 25% of all branches. The low level of confidence has been stable during 2003 to 2007 and is at approximately same level as confidence towards auto repairs and telephone subscriptions. Main reason stated in the analysis for the low confidence is not supplying at the agreed time.

DCA carried out an image survey in March 2008 to measure the level of consumer satisfaction and confidence. The survey concludes that 87% of consumers are satisfied with the quality of work and 70% with the prices.

However, 80% of consumers agree that craftsmen/contractors are not good at supplying at the agreed time, and lack the ability to keep within promised price offers and deadlines.

Just above 50% of consumers have trust in the industry, and nearly 50% of consumers perceive the industry as being “not good enough”.