2.3 Strategy Implementation

Porter & Kramer (2002 p30) state that “The way most corporate philanthropy is practiced today, Friedman is right. The majority of corporate contribution programs are diffuse and unfocused.”

To secure effective implementation of CSR there needs to be put up a business plan that secures a shared understanding of CSR and a framework that assists in the change process and supports future sustainable learning and development.

“The Sustainable Company: How to Create Lasting Value Through Social and Environmental Performance” by Laszlo (2005) helps readers understand what sustainability is, why it is important and how it can be incorporated in the organisation’s environmental and social performance.

2.3.1 Initiatives and Outcomes

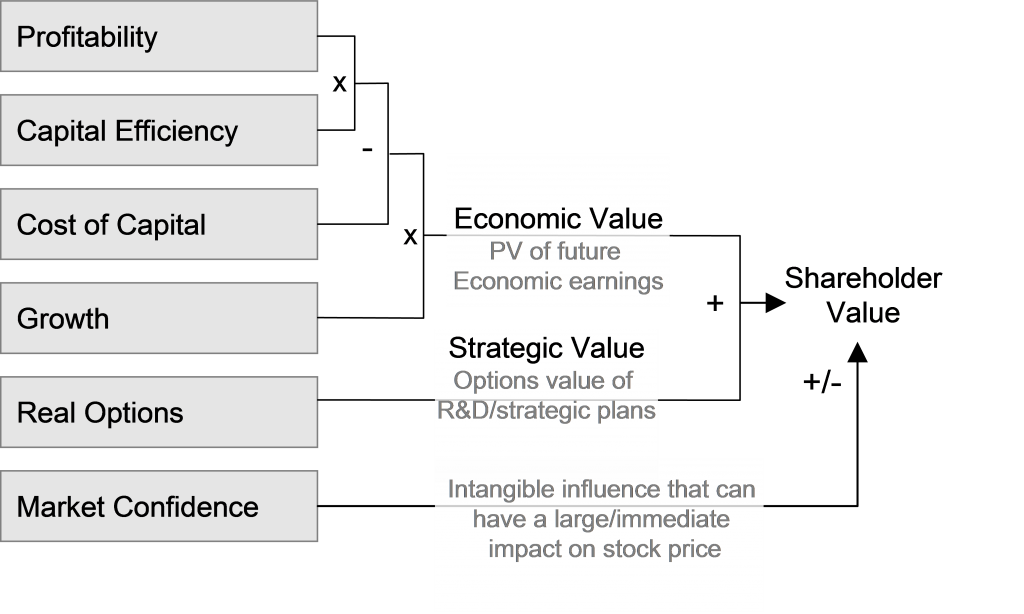

Laszlo (2005) presents the key CSR concepts along with the influence of stakeholders and their potential sources of shareholder value. Case studies in the book provide good insight in the challenges of sustainability. Measurement and benchmarking of sustainable value creation is discussed while the cultural transformation needed is explained.

Laszlo (2005) also provides a management tool kit and eight disciplines that are critical to achievement of sustainable CSR value creation. The eight disciplines are used as sub-titles below.

(1) Understand current position

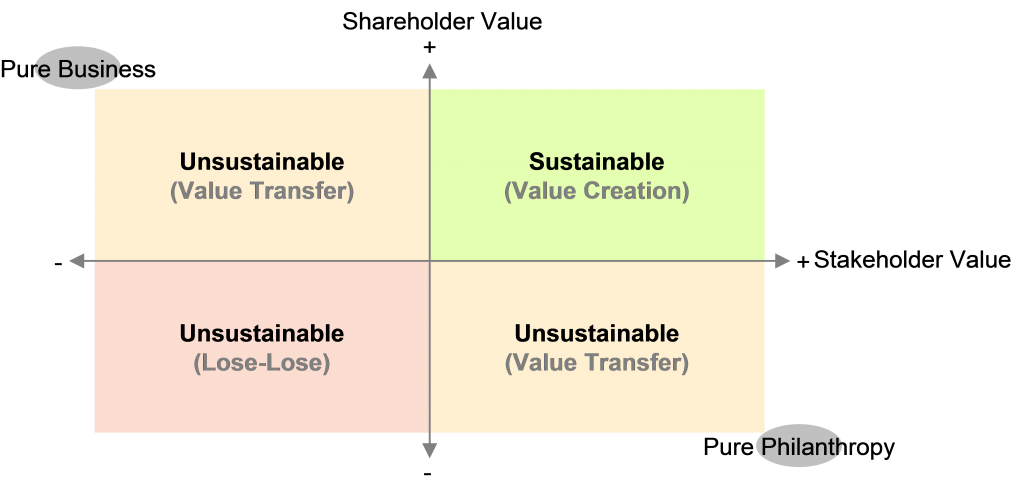

The Shareholder/Stakeholder Value Map presented by Laszlo (figure 11) enables corporations to place their business or portfolio of business-units, pro-ducts, services or geographic areas and understand the performance towards stakeholders and shareholders and in particular map and track changes over time.

The model fits well to the “Convergence of Interest” theory and model (figure 5), but supports the CSR management in a more operational way.

Shareholder value is relatively easy to determine, the CSR challenge is to identify and measure stakeholder value, and Laszlo points out that measurement of stakeholder value is an emerging field.

Laszlo describes the main kind of external CSR performance indicators that combined with regulatory measures, company management systems and direct stakeholder input allows management based on facts rather than perceived or misinterpretation.

Figure 11: The Shareholder/Stakeholder Value Map

Adapted from: Laszlo (2005 p126) & Porter & Kramer (2002 p34 & 45)

The Stakeholder Performance Indicator (SPIRIT) methodology and Relationship Improvement Tool (RIT) described by McMillan et al (2004 p27-28) based on conceptual and empirical research, could also be an approach to analyse the experiences of stakeholders influencing the relationship outcomes.

(2) Anticipate future expectations

Scenario building by identification of future expectations, evaluation of impact on issues and identification of potential future opportunities and threats are to be carried out in cooperation with key stakeholders (Laszlo, 2005 p137-138).

Building scenarios demand for creative thinking as well as analysis. However the threshold levels (described in 2.2.4), especially the cultural, forming the CSR filter may influence perceptions of the future.

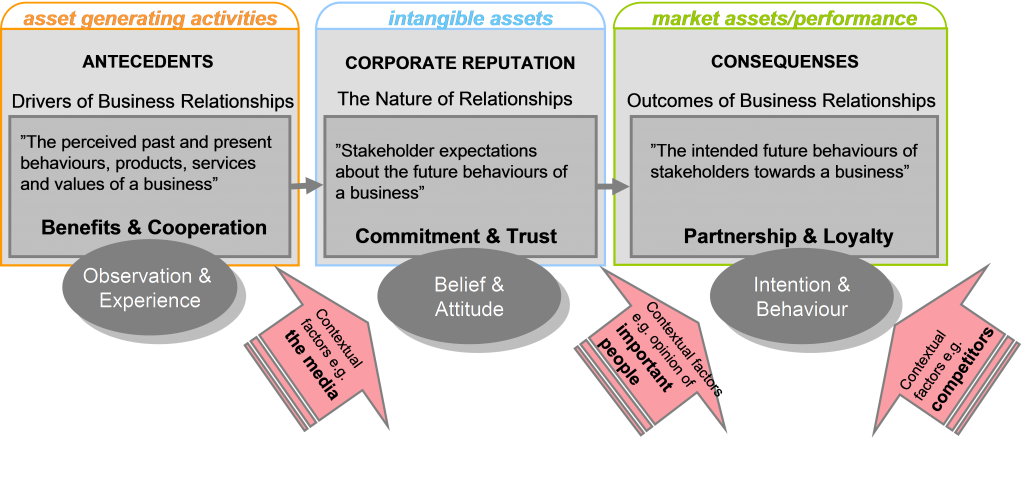

MacMillan et al (2004) defines that corporate reputation is about how a company is perceived by key stakeholders and that this depends on experience rather than public relations. They state that to manage stakeholder relationships organisations “need to develop strategies that focus not only on communications but also on many other aspects of the day-to-day experience of stakeholders”, McMillan et al (2004 p 21).

Whetten & Mackey (2002) define corporate reputation as “a particular type of feedback received by an organisation from its stakeholders, concerning the credibility of the organisation’s identity claims”.

The two definitions express that stakeholders perceived experience influence their following response.

A key issue seems to be the ability to interact with stakeholder to benefit from anticipation of future stakeholder reaction on present corporate reputation as well as innovative partnerships.

The “Simplified Model of Business Relationships” (Morgan & Hunt, 1994) assists in determining how the perceived past and present behaviours influence stakeholder’s future behaviour. This model simplifies physiological theories of communication, perception and behaviour into an easy-to-use management tool and was further developed by MacMillan, Money & Downing in 2000 (figure 12).

Figure 12: A Model of Business Relationships

Adapted from: Morgan & Hunt (1994), MacMillan, Money & Downing (2000) and Money & Hillenbrand (2006)

To secure intended and coordinated outcomes of a business’ relationships, stakeholder management principles can identify and investigate stakeholder influence on business goals (Freeman, 1984). Recognition of stakeholder responsibilities helps aligning corporation and personal self-interest with the inte-rest of others (Goodstein & Wicks, 2007), and the aim of ensuring mutual benefit secures corporate sustainability (Walker, 1998).

(3) Set sustainable values and goals

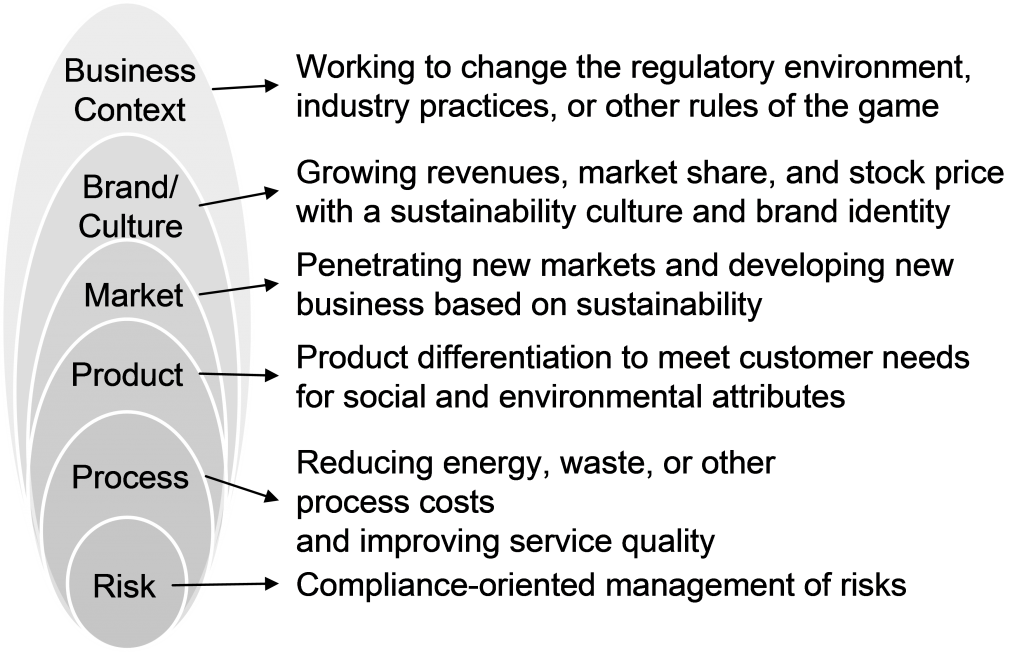

Laszlo (2006, p140) defines two key tools in formulation of the strategic intent and objectives. “The Six Levels of Strategic Focus” (figure 13) provides examples and guidelines in development of the strategic intent. The Shareholder/Stakeholder Value Map (figure 11) is used to describe present position and the intended future goals.

The combination of the six strategy focus levels and the value map also seems to be consistent with the instrumental and intrinsic difference described in the Virtue Matrix (figure 6), which also provides a good basis for understanding the strategic context and potential benefits as presented in 2.2.

Figure 13: The Six Levels of Strategic Focus

Adapted from: Laszlo (2005 p140)

2.3.2 Design, Select and Sustain Value Creation

(4) Design value creation initiatives

The CSR initiatives are to be designed so they address “The Six Levels of Strategic Focus” illustrated in figure 13.

Kotler & Lee (2005 p256-257) summarize several best practices and list the major strengths to maximize and concerns to minimize (Kotler & Lee, 2005 p258-259). Kotler & Lee (2005) describe and illustrate by cases a framework of six CSR initiatives that are to be managed by deliberate strategic decisions. The strategic decisions are to align the CSR initiatives to business values, objectives, products, markets and brands.

They emphasize that long-term CSR strategy must be linked to mainstream trends relevant to the industry. Initiatives must be appealing to target segment customers, employees and media, and demonstrate a documented difference with tangible outcomes for business and society.

The viewpoints of Kotler & Lee seem focused on marketing and they offer little empirical evidence concerning the costs related to the marketing benefits and seem based on same principles as Kotler et al (2002) with the definition of Corporate Social Marketing as “the use of marketing principles and techniques to influence a target audience to voluntarily accept, reject, modify or abandon a behaviour for the benefit of individuals, groups or society as a whole”.

Porter & Kramer (2002 p55) are clear in their view of cause related marketing and state that “it is marketing, not philanthropy, and it must stand on its own merits.”

However Kotler & Lee (2005) do describe several cases where CSR approaches have been implemented successfully, and give practical advice and instructions useful in managing product development, market penetration and development and brand differentiation.

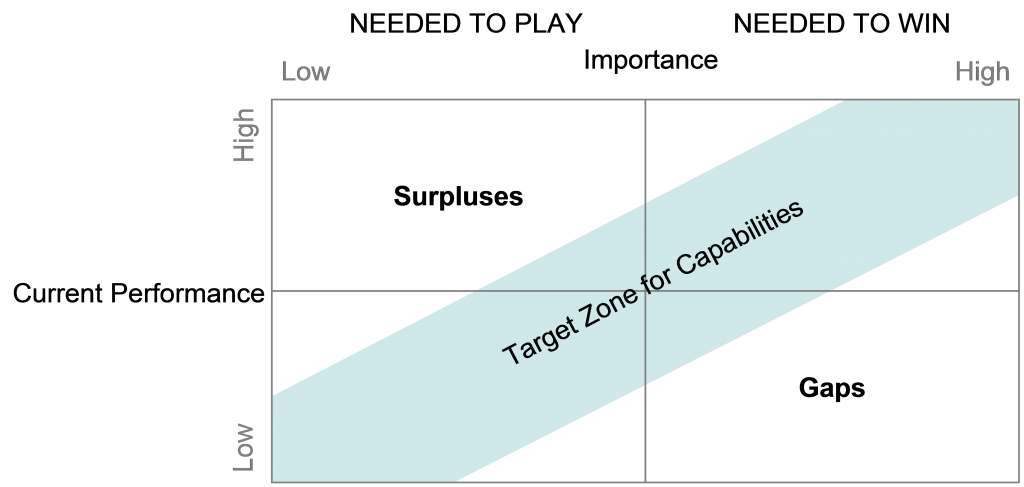

The model for “Assessing the Target Zone for Capabilities” (figure 14) assists in identifying the capability surpluses and gaps, by mapping current performance against importance of the needed capabilities, and leads to a prioritized set of initiatives that drives the corporation towards the sustainable value (win-win) quadrant illustrated in figure 11.

The needed to win capabilities are defined as key source of competitive advantage, with a clear distinction from competitors that provide higher returns through excellent performance.

Figure 14: Assessing the Target Zone for Capabilities

Source: Laszlo (2005 p149)

The needed to play capabilities are defined as required to operate without competitive advantage through superior performance. They are also the foundation which needed to win capabilities are built upon.

(5) Develop the business case

As earlier found in literature building the business case for CSR seems difficult, due to the uncertainty in measurement of future opportunities and risks. Laszlo however presents a combination of assessing value driver and the levels of strategic focus which enables calculation of shareholder value in CSR initiatives (figure 15).

Top four are the classic EVA value drivers. Strategic Value is determined as the value of real options similar to financial options as in purchase of futures and alike. Laszlo illustrates the combined calculation based on a case study of CO2 reduction in the heavy industry. The approach also contains challenges such as the ability to allocate costs and to achieve shared business logic for evaluation of shareholder value.

Figure 15: Value Drivers

Source: Laszlo (2005 p151)

McMillan et al (2004) links Corporate Governance, Corporate Reputation and Corporate Responsibility and argues that relationship focus will allow directors to manage complex areas in practical ways, and illustrates how the SPIRIT and RIT tools assist in this practice.

(6) Capture the value

Corporate reputation is by Money & Hillenbrand (2006) placed in the heart of business value creation. They found that corporate reputation was intangible assets driven by asset generating activities (or antecedents) in business relationships and that they lead to market assets and performance outcomes (or consequences) of the relationships.

Laszlo (2005 p156) states that leadership and management of environmental efficiency are to be captured within the business model and process, utilizing the existing tools and resources. He defines that collaboration in learning process with stakeholders is a key success factor as well.

(7) Validate results and capture learning

Makover (1994 p 28) states that ”Our usual training in business, still carried on mainly within industry, itself, is too narrow, too much specialized in the particular concern; it gives too few points of view on the social importance of business. No profession can really develop which does not have an intellectual content shaped broadly by many men, and this condition does not yet exist in business.” This statement was originally stated in 1927 by Wallace B. Donham in the article “The Social Significance of Business”, Harvard Business Review.

Implementation of a broader set of metrics within the organisation is described by Laszlo (2005 p157) who identifies the major challenge as CFO engagement, and engaging and enabling managers in creating a learning organisation.

Joining CSR institutes is recommended by Hopkins (2003) to secure future learning and development.

The importance of Social Responsibility Impact measurements is described by Laszlo (2005 p31) in the sentence “what gets measured gets managed.”

(8) Build sustainable value capacity

There are several principles and standards that either directly or indirectly support sustainability of CSR within the corporation.

An overview of some of the most common is provided in appendix 3.