2.2 Strategy Development and Selection

Werther & Chandler (2006 p xxii) believes that the scope of CSR “is a mosaic of issues. Which issues are most important today or tomorrow evolve with changes in society and competitive environment.” They describe the strategic context of CSR based on stakeholder management, and offer a framework for applying CSR into the strategy building process.

2.2.1 Stakeholders, Vision and Mission

Stakeholder relationship and management is described by Werther & Chandler (2006) to be the core of CSR strategy. This fits with the definition of responsibility by McMillan et al (2004 p24) as “company behaviour which generates trust and support of key stakeholders”.

A vision statement formulates the long-term state the corporation is pursuing and addresses the stakeholder needs the corporation solves. Mission statements are to describe the type of activities the corporation is performing to secure stakeholder satisfaction and to achieve the vision (Johnson et al, 2005).

Recognition of CSR stakeholder responsibilities helps aligning corporation and personal self-interest with the interest of others (Goodstein & Wicks, 2007), and the aim at mutual benefit secures sustainability (Walker, 1998). Goodstein & Wicks highlight the importance to maintain committed and loyal to mission and values in cooperation with others. This point is supported by John Rawls (2001 p211) and Robert A. Philips (1997 p57) who add that co-operation must be voluntary and fair.

Referring back to the Convergence of Interest model (figure 5) several benefits of CSR stakeholder selection and management can be identified in the literature.

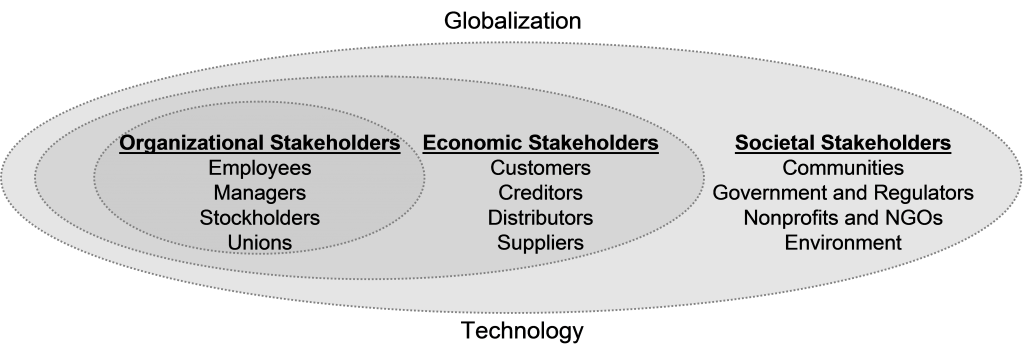

The importance of these benefits and the issues driving or restraining the stakeholder relationships are structured in the CSR stakeholder groups identified by Werther & Chandler (2006 p4) and discussed below (figure 7).

Figure 7: A Firm’s Stakeholders

Source: Werther & chandler (2006 p4)

Organisational Stakeholders

Organisational stakeholders exist within the organisation and include stockhol-ders, employees and managers.

CSR is seen to increase the ability to attract, motivate and retain employees and to increase the appeal to investors and financial analysts. These benefits are supported by among others Pearce and Doh (2005), Gardberg & Fombrun (2006), Kotler & Lee (2005), Makover (1994) and Vogel (2006).

There is however several restraining issues to be found in literature, among which majority is connected the leadership role.

Martin (2002 p97) states that “The most significant impediment to the growth of corporate virtue is a dearth of vision among business leaders.” He sees lack of imagination and motivation as the reason, and argues that frontier (figure 6 “The Virtue Matrix”) activities are driven by leaders’ own interest and that this is the only way to create benefit.

Carlson & Perrewe (1995), Ciulla (1999), Parry & Proctor-Thomson (2002) all support that leadership is the key driver of corporate ethics contributing to a corporation’s overall performance in terms of CSR.

Economic Stakeholders

Economic stakeholders such as customers, suppliers and creditors are in the interface between organisational and societal stakeholders.

CSR is seen to strengthen brand position, attract and retain customers, improve competitive position, increase market share, reduce risk and lower costs in supply relationships. These benefits are supported by among others Vogel (2006 p30-32), Kotler & Lee (2005 p21), Porter & Kramer (2002), Makover (1994 p71) and Mills & Robertson (1999).

However several restraining issues are found in literature among which majority is connected to measurement of CSR brand value outcomes (Svendsen, 1998).

Measuring success in terms of outcomes for both the corporation and stakeholders is seen to be an important issue for valuating the benefits of CSR by McMillan et al (2004), Handy (2002 p81), Makover (1994 p21), Laszlo (2005 p107) and Kaku (1997 p122).

Societal Stakeholders

Societal stakeholders exist outside the organisation and include communities, government, regulators, nonprofits, non governmental organisations and the environment.

CSR is seen to improve reputation, increase competitive advantage, increase intangible and tangible assets, reduce costs, increase speed of environmental approvals and reduce the risk of negative intervention and legislation. These benefits are supported by among others Hopkins (2003 p26-30), Moss Kanter (1999) and Laszlo (2005 p40-43) whom provide hard concrete figures documenting the financial outcomes for investing in CSR in the concrete business.

The social benefits are well documented in literature, but Vogel (2006) finds that government intervention (regulation or litigation) is the largest motivating factor for improvements. He believes that voluntary corporate CSR approaches are based on personal motivation (Vogel 2006 p13) in a form of (Vogel 2006 p18) “enlightened self-interest” among business leaders.

The difference in perception of the benefits of CSR is surprisingly clear despite several well documented sources of benefits. It seems that there could be internal or external constraints for not adopting CSR.

2.2.2 Organisational and Environmental Constraints

Werther & Chandler (2006 p45) describe the two areas of organisational and environmental constraining forces limiting the CSR strategy creation, which are discussed in the following sections.

Organisational Constraints

Corporations build resource based strategies based on their resources and capabilities to either develop new product and marketing opportunities or react to competitor moves (Thompson & Martin, 2005 p143).

Vogel (2006 p12) criticises the view on CSR as being the purpose of business. He addresses however the need for corporate change in reconciliation of social values and business system (Vogel, 2006 p28).

The opportunities for CSR marketing development described by Laszlo (2005 p40-43) based on case study in the cement and concrete industry and the product developments described by Kaku (2005 p114) set the demand for utilizing resources and developing capabilities in a new way. Kaku (2005 p121) moves further and suggests that co-operation with competitors based on own distinct capabilities and resources are needed on the CSR agenda.

Resources

Handy (2002 p73) argues that there is a need for considering employees as assets rather than costs to be minimized, as they are the intellectual capital in CSR. Moss Kanter (1999) supports this and suggests that instead of writing checks or doing physical hours of work, business must use their best people and their core skills to achieve social innovation.

Considering the potential benefits of CSR, decisions regarding investment in initiatives and allocation of resources appear to be a matter of business case formulation.

Capabilities

Innovation is seen to drive productivity according to Porter & Kramer (2002 p50), and they argue that the greatest advances come from new and better approaches rather than efficiency. They state a need for developing new means of innovation to address social problems.

The ever-evolving scope of CSR is addressed by Frederick (2006 P129-135) who clearly defines the need for new capabilities in motivation, innovation, neural networks and mutual goal achievement.

Frederick (2006 p. 104) also describes the reasons for being unethical based on research conducted in 1977. Leadership is the main reason, second is formal policy (or lack of) and third is the industry ethical climate.

Environmental Constraints

Corporations build market based strategies based on the threats and opportunities or react to competitor moves (Thompson & Martin, 2005 p112-113).

The threat perspective fits well to government intervention as being the largest motivating factor for CSR improvements as discussed earlier. If there is any reluctance in actions on competitive threats and market opportunities it would be a direct opposite to Friedman’s (1982) argument that free markets would solve social and political problems that other systems have failed to address adequately.

Reasons for not responding to CSR opportunities or competitive threats seem non-existent. Werther & Chandler (2006 p45) describe the environmental constraints as the “sociocultural-legal-stakeholder environment”, which seems to fit to the threshold levels in figure 6 “The Virtue Matrix”.

2.2.3 Threshold Differences “CSR Filter”

The decision of when, why, where, how and by whom to implement a CSR strategy is influenced by differences in industry, company and cultural threshold levels (Werther & Chandler, 2006 p63-65). The issues influencing these levels are discussed further below.

Industry Threshold Level

Hopkins (2003 p133) states that Denmark (among three others) “are forced to interact on global markets because of their small domestic markets”. Hopkins argues that Danish companies have become some of the most open and efficient exporters in the world, and at the same time have become known for high levels of social and environmental responsibility at home.

International corporations or sectors are described to be particularly affected by political, social and environmental issues (McMillan et al, 2004 p22), however community and media may be more direct to one company.

The competitive situation (Porter’s “Five Forces”, 1980) may also be influenced by the position in the value network illustrated in figure 1. If positioned close to the consumption it appears, from the quantity of corporations, to be a more competitive situation than positioned in raw material. Differences in threat of substitutes and barriers to entry could also influence the value network. There may also be difference in government regulations, norms and standards influencing the CSR threshold levels of the different value chains in the network.

Utilizing capabilities created by a high domestic threshold level to compete on international markets may be a competitive industry advantage. However a lesson learned in case stories (Vogel, 2006 p126) on Corporate Environmental Responsibility is that internal initiatives reducing costs are the easiest way to demonstrate serious company commitment to reduce emissions. Consumers are willing to do-the-right thing, but only if it is easy.

Exceeding the threshold level of CSR however is not necessarily just cost related, and Vogel (2006 p163) lists several examples of companies that are doing more good and better than governments.

Company Threshold level

Porter & Kramer (2002 p31) state that “Corporations can use their charitable efforts to improve their competitive context – the quality of the business environment in the location or locations they operate.” This is supported by Vogel (2006, p21) who also argues that the competitive position is improved, but that virtue is not business in itself, only a niche strategy just as not being responsible is (Vogel 2006 p16). He clarifies this by explaining that there is a competitive place for more or less responsible firms and that this is connected to the mission.

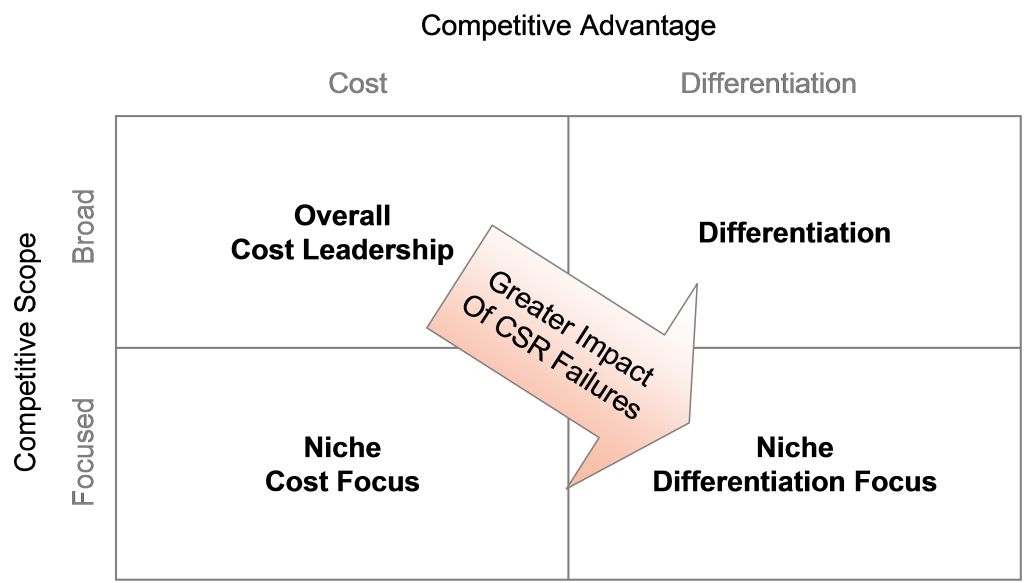

Differences in CSR strategies are described by Werther & Chandler (2006 p65) to be dependent of the competitive advantage and scope. By applying the impact level of CSR failures to the business level strategy (figure 8), it is illustrated that companies base their threshold level according to the business strategy to minimize risk.

Figure 8: Business Generic Strategy and CSR Threshold

Source: Adapted from Werther & Chandler (2006 p65) and Porter (1980)

This point is somewhat questioned by Smith (1994 p168) stating that “Compe-ting on price and corporate citizenship is smarter than competing on price alone”. Vogel (2006 p33) also addresses the strategic risks associated with CSR and argues that the risks associated with CSR are no different than those associated with any other business strategy.

The previously described differences in competitive position and the corporation’s level of internationalisation and difference in pressure from community and media could also influence each corporation’s approach to CSR.

This challenge is addressed by Mackover (1994 p22) who states the need for CSR initiatives to reflect the organisational size, sector and culture and sees a link to underlying social and business rationales to secure impact and sustainability of CSR initiatives. Attuning the responsible behaviour to culture is by Basu & Palazzo (2008) a prerequisite to secure authentic CSR engagement.

Cultural Threshold level

As the benefits are clearly documented, any resistance to change appears to be based on other factors than facts. According to Kotter & Schlesinger (1979) there are four reasons for resistance to change; parochial self-interest, misunderstanding, low tolerance of change and different assessment of the situation.

Working towards an integrated bottom line demands according to Laszlo (2005 p46-47) a shift in learning, innovation and approach towards partnership. To create an open partnership alignment of culture is a key point (Laszlo, 2005 p46-47) and a prerequisite for uniform assessment of the situation is illustrated by the following discussion.

The shared responsibility and ethics in partnerships are highlighted as well by Goodstein & Wicks (2007), who state the need for shared responsibility for negative outcomes of demand as well as positive.

Accepting to cover for partner’s negative outcomes challenges the corporate conscience that can be compared to personal moral, which according to Goodpaster & Matthews (1982) influence the decisions of profit versus social responsibility.

This moral or ethical dilemma is suggested by Hopkins (2003 p83-84) to be managed by a shared codes of ethics towards the previously mentioned stakeholders, and Hopkins (2003 p22) sees trust and CSR as closely linked to be successful.

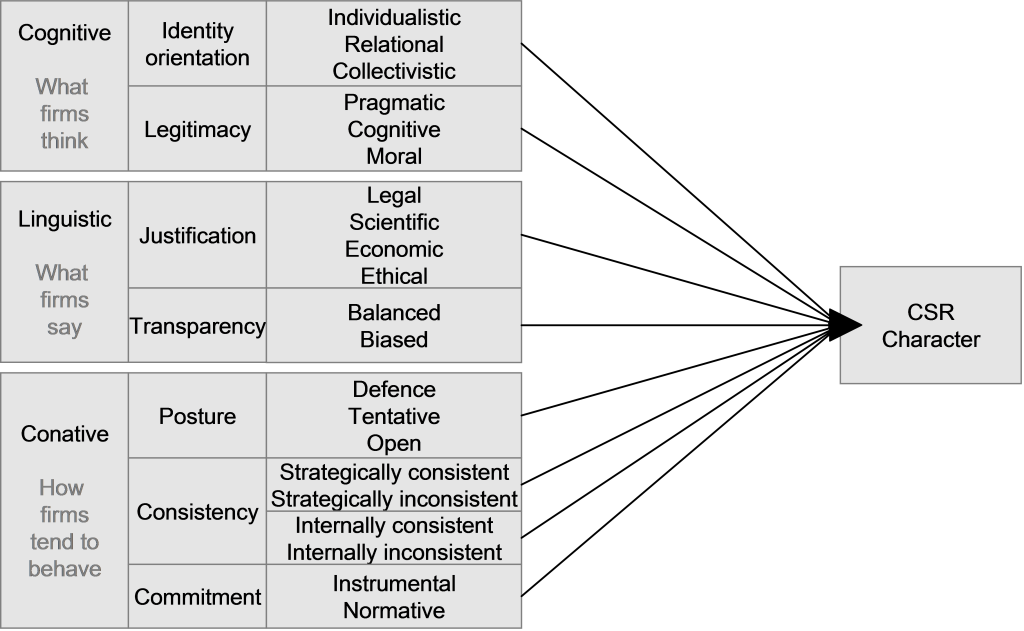

Basu & Palazzo (2008 p124) describe that outcomes of CSR are linked to variety in organisational sense making (figure 9).

They see organisations as acting within their own perceived environment, making decisions based on internal embedded cognitive and linguistic processes, rather than acting as a direct result of external demand.

The patterns in organisations cognitive and linguistic sense making patterns can be analysed, and assist in understanding cultural differences between the organisation and the external environment. If the organisation is able to match the external sense making it will be able to reduce resistance to change and increase the value of CSR outcomes.

Mental models or frames underlying the sense making thus influence how the world is perceived. As Pfeffer (2005 p128) describes it in a perhaps easier way to perceive “What we do comes from what and how we think”.

Figure 9: CSR: Dimensions of the Sensemaking Process

Source: Basu & Palazzo (2008 p125)

The theory of sense making also seems to fits with the “Simplified Model of Business Relationships” (Morgan & Hunt, 1994) where the perceived past and present behaviours influence future expectations of relationship outcomes. This model simplifies the physiological theories of perceptions, communication and behaviour into an easy-to-use management tool.

There needs to be a match between the stakeholders’ perceptions of the need for CSR and their behaviour to achieve the expected outcomes of CSR for an organisation.

2.2.4 Strategy Selection

As illustrated and described in “The Virtue Matrix” (figure 6) there are two frontiers where CSR initiatives can be grouped. Strategic that maximizes organisations’ profit or structural that only shares the benefit of society.

Martin (2002 p94) states that to earn public credit organisations must engage in activities that resides in the strategic frontier. This is where the public sees social or environmental benefits to be gained. The challenge is to invest in innovation.

Activities that are not demanded (or valued enough) by consumers reside in the structural frontier, and the best way to increase the threshold level is by collective action (Martin, 2002 p98).

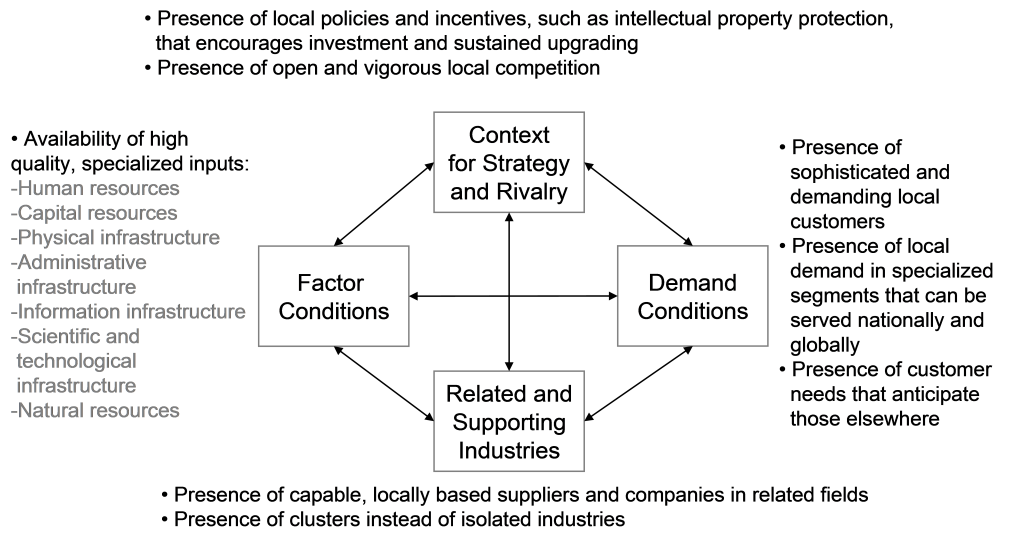

Clusters of interconnected companies, such as suppliers, related industries and specialized institutions in a particular field are seen to create national competitive advantages (Porter & Kramer, 2002 and Porter, 1990).

Figure 10: The Four Elements of Competitive Context

Source: Porter & Kramer (2002 p36)

Four elements creating competitive advantage have been determined by Porter & Kramer (2002 p36). They describe how industry CSR activities can create distinct competitive resources, competencies, innovation and low cost advantages etc. and thus improve the competitive attractiveness of a whole industry (see figure 10).

Porter & Kramer (2002) also argue that free riders not contributing in Corporate Philanthropy do not necessarily negate strategic value.

The formulation of a CSR strategy is to take advantage of the changes in society and maximise economic performance. The CSR strategy is to give direction of how the needs of stakeholders are to be satisfied in order to maximise shareholder value and minimise risk (Werther & Chandler, 2006 p61).